When December air turns frosty, children of all ages envision sleigh bells and a cornucopia of gifts. Business owners make their own wish lists. But instead of letters to Santa, they dream of year-end tax deductions. With Section 179 of the tax code offering more tax relief than ever, small businesses can make those dreams a reality with upgraded technology.

Recent Changes Bring Business Benefits

The Tax Cuts and Jobs Act, which took effect last year, introduced some key adjustments to Section 179 and bonus depreciation that put even more money back into the business budget. These changes include the following:

- Deduction limit doubled – For new and used equipment purchased and put into use before the end of the year, the total amount you can deduct has increased to $1 million. This also applies to off-the-shelf software. The deduction limit adjusts annually for inflation.

- Spending cap now $2.5 million – Once Section 179 expenses exceed $2.5 million, the deduction begins to phase out. That is, if you spend between $1 million and $2.5 million, you take the full $1 million deduction. After $2.5 million, your tax write-off begins to decrease by one dollar for every extra dollar spent.

- Bonus depreciation increased to 100 percent – Once you reach the deduction limit, you can elect to take bonus depreciation on remaining items. That means that you can now take the full depreciation in the first year, instead of spreading it out over several years.

For example, a business takes advantage of the opportunity to replace aging computers and upgrade the computer network. With qualifying expenses totaling $1.2 million, the business qualifies for the $1 million deduction. It then takes the bonus depreciation for the remaining $200,000. In a 35 percent tax bracket, the business thus gains $420,000 in tax write-offs.

Section 179 Items to Add to Your Holiday Shopping List

With the December 31 deadline fast approaching, now is the time to start making strategic technology investments. You might upgrade computers and laptops to increase productivity, for instance. Or, you can take the opportunity to beef up cyber security and increase data storage.

- Desktop computers – Opt for high power in a small package with the HP Z2 Mini G4. Alternatively, architects and other creative professionals will reach for the stars with the all-in-one Microsoft Surface Studio 2.

- Business laptops – Consider the lightweight yet durable HP EliteBook, or choose the graphics capabilities and performance of the Microsoft Surface Book 2.

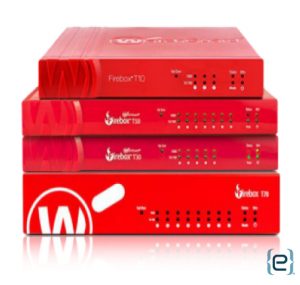

Updated security – Invest in a quality firewall with WatchGuard Firebox T10-W or T30-W. Combine a next-generation firewall with multi-year, comprehensive antivirus and antimalware protection. Ideal for small business, distributed enterprises, and MSSPs that need a powerful solution that can be quickly deployed in remote locations and centrally managed.

Updated security – Invest in a quality firewall with WatchGuard Firebox T10-W or T30-W. Combine a next-generation firewall with multi-year, comprehensive antivirus and antimalware protection. Ideal for small business, distributed enterprises, and MSSPs that need a powerful solution that can be quickly deployed in remote locations and centrally managed.- Finally upgrade to Windows 10 – If your office has waited until the bitter end to ditch Windows 7, now is the time to upgrade. Windows 7 reaches end of life in January 2020, meaning Microsoft will no longer support it. To increase performance, consider also adding RAM and switching out old hard drives for Solid State Drives (SSD).

- Expandable servers for a growing business – Whether you use servers for data storage, website hosting or email, you need to purchase with growth in mind. For instance, the HPE ProLiant ML350 Gen 10 can be converted from a tower server to a rack server as your business expands.

Maximize Your Purchasing Power with Expert Advice

Tap into the expertise at eMazzanti to capitalize on the tax savings waiting for you. We can guide you through the maze of hardware and software options available and help you forecast your technology needs moving forward. Contact one of our Section 179 technology specialists today to begin the process.